Table of Contents

In this high-stakes industry, the right NEMT insurance broker can be the difference between smooth operations and costly setbacks.

Insurance brokers are critical to a successful non-emergency medical transportation (NEMT) business.

With the assistance of a qualified NEMT insurance broker, you can rest assured that your business is in good hands and that you don’t have to stress about handling accidents on your own if they occur.

In this article, we will learn how to choose the right NEMT insurance broker, the top factors to consider in your selection, and how to evaluate their network and partnerships.

Expertise in NEMT Insurance

An NEMT insurance broker will know how to handle the unique risks in NEMT operations effectively.

Whether vehicle accidents or strict compliance with healthcare and transportation regulations, NEMT businesses face specific challenges requiring specialized knowledge. While a general insurance company may not understand these challenges, an expert NEMT insurance broker can help minimize and mitigate risks.

When choosing an insurance broker, providers should seek businesses with a history of working with NEMT clients. Brokers with NEMT expertise are more likely to bridge gaps in coverage or costs.

An experienced NEMT broker will be able to anticipate and address the unique risks associated with your business. NEMT broker should be well-versed in the following:

- State and federal regulations, including Medicaid and Medicare standards

- Have access to insurers that focus on transportation and healthcare sectors.

So, before choosing a broker, ask them about their NEMT clients and the types of coverage they’ve recommended. This can give you an insight into their understanding of the NEMT field.

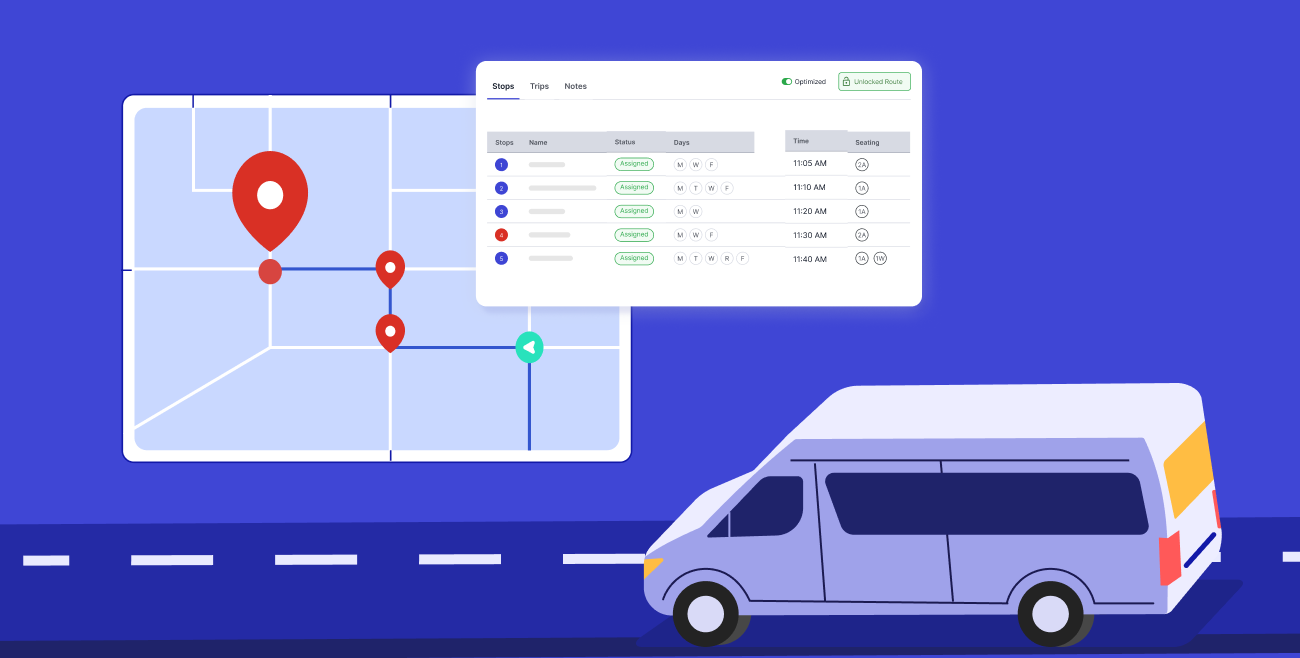

Do More with Less

Handle more trips with fewer dispatchers on your payroll with Tobi.

Request a DemoComprehensive Coverage Options

Wouldn’t having an expansive list of coverage options catering to your business’s needs be great? Or would having someone make the right choices for you make your business operations smoother?

An NEMT insurance broker can do this and more.

Since NEMT businesses have varied needs and face unique risks, special policies must be followed. Inadequate or mismatched coverage can leave your business stranded.

Experienced brokers should tailor insurance packages with core coverages like:

General Liability

General liability protects against claims of bodily injury, property damage, or accidents outside your vehicles.

Let’s say a passenger trips on the curb while being escorted to your vehicle and sustains injuries. General liability would help cover medical expenses and legal costs.

Workers’ Compensation

Workers’ compensation covers employee injuries that may occur during patient assistance.

It helps cover medical bills and protects your business from potential lawsuits.

Auto Liability

It covers damage and injuries from vehicle accidents involving company-owned or operated vehicles.

If one of your vehicles is rear-ended while transporting a patient, auto liability helps cover the associated medical and repair costs.

Add-ons like Cyber Liability and Umbrella Policies

Cyber liability covers risks related to data breaches.

If your business handles sensitive patient information, then this can help with regulatory fines, notification costs, and credit monitoring services for affected clients.

Umbrella policies provide liability protection that kicks in when your primary policy limits are reached.

Before choosing coverages, ensure the broker explains limits and exclusions so you and your business are not stranded in the dark. Also, compare quotes side-by-side to decide what fits your needs and budget.

Responsive Service and Claims Support

Imagine there has been an accident or claim. Your broker’s responsiveness can impact the recovery time.

NEMT providers need swift and reliable support during an accident or incident to minimize downtime and disruption to service.

Choosing a broker who offers reliable, accessible support when it matters most can make a substantial difference in keeping your NEMT business on track during unforeseen events.

Here’s what you should keep an eye out for in your insurance broker:

Accessible and Reliable Communication

Look for brokers who are responsive and prioritize communication.

In the event of an accident, you’ll want a readily available broker for quick guidance on reporting and starting your claim.

For example, your vehicle gets in a fender-bender, and you need quick answers about the next steps, such as how to file the report and whether a replacement vehicle is covered.

A responsive broker with a dedicated claims line will make this process easier.

Clear Guidance Through the Claims Process

Suppose your business faces a complex claim after an accident involving multiple vehicles and a passenger injury.

Your NEMT insurance broker will walk you through each step, explaining which medical documents are necessary, gathering witness statements, and communicating with other insurance companies to handle claims efficiently.

Strong Reputation for Client Support

Your broker should have a proven track record of supporting clients with their challenges.

The best brokers advocate for their clients, push for fair settlements, and provide timely follow-ups for satisfactory resolutions.

Running thorough background checks on your broker through online reviews and client testimonials can be the insight your business needs.

Protect Your Business with the Right Partner

Choosing the right NEMT insurance broker is a deciding factor for your business’s success and security.

An experienced broker understands the unique challenges of this expansive and evolving industry. They can help you navigate the specific coverage needs required to keep your business, staff, and passengers safe.

Comprehensive coverage and excellent service are the core aspects of a knowledgeable broker. These are not checkboxes but safeguards against the unexpected and reliability for questions, claims, and changes.

Wouldn’t having someone steer you in the right direction be helpful?

Your NEMT insurance broker should be more than a vendor; they should be a partner in your success. Are you ready to make the right choice for your business?

Ready to see how Tobi can help your business thrive? Find out how our NEMT software helps make your business better at every turn.

I loved as much as you will receive carried out right here. The sketch is attractive, your authored material stylish. nonetheless, you command get got an impatience over that you wish be delivering the following. unwell unquestionably come more formerly again since exactly the same nearly a lot often inside case you shield this hike.